Fraud Protection

🚨 Current Phone Spoofing Situation 🚨

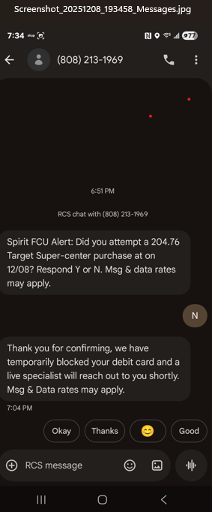

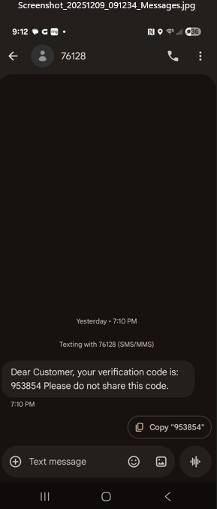

Fraudsters are calling our members from a phone number with an 808 area code and impersonating our Fraud Department. Please do not answer the call. If you do, the fraudster will tell you there are fraudulent transactions on your account. They will then send you a text message with a code and ask you to provide them with the code. This code provides access to your account.

Spirit Financial or our actual Fraud Department will never pressure you to act immediately, click a link, or provide a code via text message. All Text messages from our Fraud department come from 86975.

If you ever doubt the legitimacy of a message, trust your instincts. Contact us directly using the official phone number on our website or your account statement, never the number provided in a suspicious text. Our team will gladly verify any communication.

Enhancing Your Mobile Security

You can add another layer of protection right from your device:

On iPhone:

Go to Settings → Messages and enable Filter Unknown Senders to separate unknown or suspicious messages.

If you have upgraded to iOS 26, enable the Screen Unknown Callers feature and select “Ask Reason for Calling”.

On Android:

Open Messages → Settings → Spam Protection and turn it on to automatically detect and flag scam texts.

When you block or report fraudulent numbers, you’re helping mobile providers and law enforcement track and shut down scams faster, protecting yourself and others.

Here’s what these fraudulent text messages look like:

How to Identify a Legitimate Message from Spirit Financial Credit Union

When Spirit Financial contacts you, our messages will always:

Be written in clear, professional language that includes your name.

Never ask you to share passwords, PINs, codes or full account numbers.

Guide to Protecting Yourself from Emerging Investment Fraud

Online romance and “secret” crypto tips are becoming the front door to one of today’s most devastating scams: pig butchering fraud. If you spend time on dating apps, social media, or texting with people you don’t know in real life, you’ll want to understand how this scheme works and how to shut it down before any money leaves your account. Read our Ultimate Guide to Protecting Yourself from Emerging Investment Fraud to learn the warning signs and steps to protect your savings.

Anatomy of a High-Tech Wi-Fi Heist

Public Wi-Fi isn’t always as friendly as it looks. Cybercriminals are now creating “evil twin” networks that mimic real hotspots to steal logins, card numbers, and even your identity. Learn how to spot these fake networks and keep your accounts safe by reading our blog, “Evil Twin Wi-Fi Dangers: Anatomy of a High-Tech Wi-Fi Heist.”

Beware the Imposter's Call: Understanding Phone Spoofing Scams

In the ever-evolving landscape of fraud, criminals are constantly refining their tactics to deceive and defraud. One increasingly prevalent method is phone spoofing, a technique where scammers manipulate caller ID to display a familiar or trusted number, such as that of your financial institution. Recently, members have reported receiving calls that deceptively appeared to originate from Spirit Financial Credit Union, with the caller probing for account details and recent activity.

It's crucial to understand that these calls are not genuine. Fraudsters employ spoofing to lower your guard, hoping you'll be more inclined to share sensitive information believing you're speaking with a legitimate representative. The potential consequences of falling for such a scam can range from unauthorized access to your accounts to the theft of your personal identity.

Empower Yourself Against Spoofed Calls:

We Initiate Nothing Sensitive Via Outbound Calls: Please be aware that Spirit Financial will never proactively call you to request sensitive personal or account information. If you receive such a call, it is almost certainly fraudulent.

Your Verification is Your Power: If you have any doubt about the legitimacy of a call, do not engage. Hang up immediately and call us directly using the official phone number listed on our website or your account statements. This ensures you are connecting with a genuine representative.

Guard Your Privacy Diligently: Never disclose personal information, account numbers, passwords, or any other sensitive details over the phone unless you initiated the call and are certain of the recipient's identity.

If you have been targeted by a call like this or have noticed any suspicious activity related to your account, please contact us without delay. Your vigilance is a vital component in safeguarding your financial well-being.

Data Breach: The Ripple Effects of Data Exposure on Consumers

The recent breach at National Public Data has exposed over 2 billion personal records, leaving countless individuals vulnerable to identity theft, financial scams, and phishing attacks. This massive data leak has serious implications for those affected, from immediate threats like fraudulent credit accounts to long-term consequences such as damaged credit and emotional distress. Learn more about the risks associated with this breach and discover essential tips to protect yourself in our latest blog post.

Discover the Future of Fraud Protection: Biometric Security

In today's digital world, traditional security methods are falling short. Biometric security, using unique traits like fingerprints and facial recognition, offers a powerful solution. Our latest blog post, "Biometric Security: The Future of Fraud Protection in the Digital Age," dives into how this technology enhances fraud prevention in finance, e-commerce, and healthcare.

Stay informed and protected. Read the full article to learn more about the advancements and benefits of biometric security.

Emerging Threat: Deepfake Technology Scams

In an era where the distinction between reality and digital fabrication grows ever thinner, the emergence of deepfake technology stands as a formidable challenge, blending the art of deception with cutting-edge AI to create illusions alarmingly close to reality. This technology, once the domain of entertainment and harmless creativity, has morphed into a weapon wielded by scammers to perpetrate frauds that range from impersonating high-profile figures to manipulating public opinion. Our latest blog post, "Emerging Threat: Deepfake Technology Scams," delves into the depths of how deepfakes are being used to deceive and defraud, showcasing chilling examples such as a CFO being impersonated to swindle millions and the political arena being manipulated with counterfeit videos. As these scams proliferate, understanding and recognizing the signs of deepfake manipulations become crucial. Dive into our comprehensive guide to arm yourself against the cunning of deepfake scams.

Stay Alert for Scams: Spirit Financial Will Never Contact You to Request Personal Information!

At Spirit Financial Credit Union, we prioritize the security and privacy of our members. Scammers often target credit union members and bank customers through fraudulent phone calls, attempting to deceive them into revealing sensitive information such as logins and access codes. We want to assure you that Spirit Financial Credit Union will never contact you to request personal information over the phone. Your trust and security are of paramount importance to us.

If you receive a suspicious call asking for personal information, it is crucial to stay vigilant. Hang up immediately and do not disclose any sensitive details. Instead, contact us directly using trusted channels to report the incident. Our dedicated Member Service team is here to assist you and ensure the safety of your financial accounts.

Remember, protecting your personal information is a joint effort. We urge all our members to remain cautious, verify requests independently, and rely on official communication channels. Together, we can stay one step ahead of scammers.

BEWARE OF PHISHING

Phishing continues to top the list of scams we are falling victim to, with 300,497 complaints filed last year. Phishing, vishing, and smishing are all methods of identity fraud that differ in how a scammer contacts a victim – via email, phone, or text – with the goal of stealing personal or financial information. Other internet crimes topping the list include personal data breach and extortion.

CRYPTOCURRENCY SCAMS

In 2022, investment scams were some of the highest dollar losses reported to IC3. Investment fraud complaints increased from $1.45 billion in 2021 to $3.31 billion in 2022 - a whopping 127% increase. Included in investment scams, cryptocurrency fraud rose from $907 million in 2021 to a staggering $2.57 billion in 2022, a 183% increase. This includes losses to cryptocurrency support impersonators. Crypto owners are falling victim to scammers impersonating support or security from cryptocurrency exchanges in record numbers. The Federal Trade Commission (FTC) provides consumers with tips to spot and avoid cryptocurrency scams.

TECH SUPPORT FRAUD

Similar to what we mentioned regarding cryptocurrency, we’re also seeing a dramatic increase in criminals claiming to provide customer service, security, or technical support to potential targets in order to gain access to accounts or get other personal or financial information. Tech support scammers may impersonate legitimate tech companies offering to fix non-existent issues or renew fraudulent software or security subscriptions. They may also impersonate tech support from a credit union, bank, or other financial institution.

According to the AARP, tech support scams were the most often reported category of fraud against people aged 60 and older last year. IC3 reported that victims over the age of 60 lost over $724 million to these scams, with some losing their entire savings and even their homes. Tech scammers primarily use pop-ups, but also use text messages, emails, and robocalls to steal from victims.

TEXT SCAMS

According to the FTC, in 2022 there were $330 million in losses to text scams that were reported to the FTC’s Consumer Sentinel Network. This includes copycat credit union and bank fraud prevention alerts, fake package delivery problems, and fake Amazon security alerts among others. Click here to learn more about guarding against text scams.

Protect Yourself from Scams

TRUST YOUR INSTINCTS

If something seems amiss, it probably is. Remember that scammers will often urge you to act immediately. Don’t fall for the “act now” bait.

DON'T RESPOND

Don’t answer calls, texts, or emails if you are unsure of who the caller or sender is. If it’s important, the caller will leave a voicemail. If you think a message might be legitimate, contact the person or organization via their official phone number or email, rather than replying directly to a sketchy text or email.

CHECK BEFORE YOU CLICK

Do not click on any links in emails or texts if you are not absolutely certain they are legitimate. Clicking without thinking can put your device’s security in jeopardy. If you simply hover your mouse over a link it will reveal the entire URL, which may help you determine if it is legitimate.

PAY WITH CARE

Use legitimate peer-to-peer payment apps, such as Venmo, Cash App, and Zelle carefully, and only with individuals you know.

NEVER SEND MONEY TO SOMEONE YOU DON’T KNOW

No matter what the claim, don’t fall for it.

NEVER SHARE PERSONAL OR FINANCIAL INFORMATION WITH SOMEONE YOU DON’T KNOW

Scammers will often try to bait you into providing information for identity theft purposes.

Report a Scam

If you feel you’ve been scammed, report it immediately. Tap to learn more about how to report a scam to your local and federal government officials. You can also report most scams directly to the FTC. Spirit Financial Credit Union members are also encouraged to report possible scams to Spirit Financial directly by calling or texting Member Services at (267)-580-0230 or by emailing memberservice@spiritfinancialcu.org.

Security Resource Center

Learn more about the tools available to Spirit Financial members that enable you to proactively safeguard your accounts.